are combined federal campaign donations tax deductible

Can a deduction to a political campaign be deducted on the donors federal income tax return. Are Combined Federal Campaign Donations Tax Deductible.

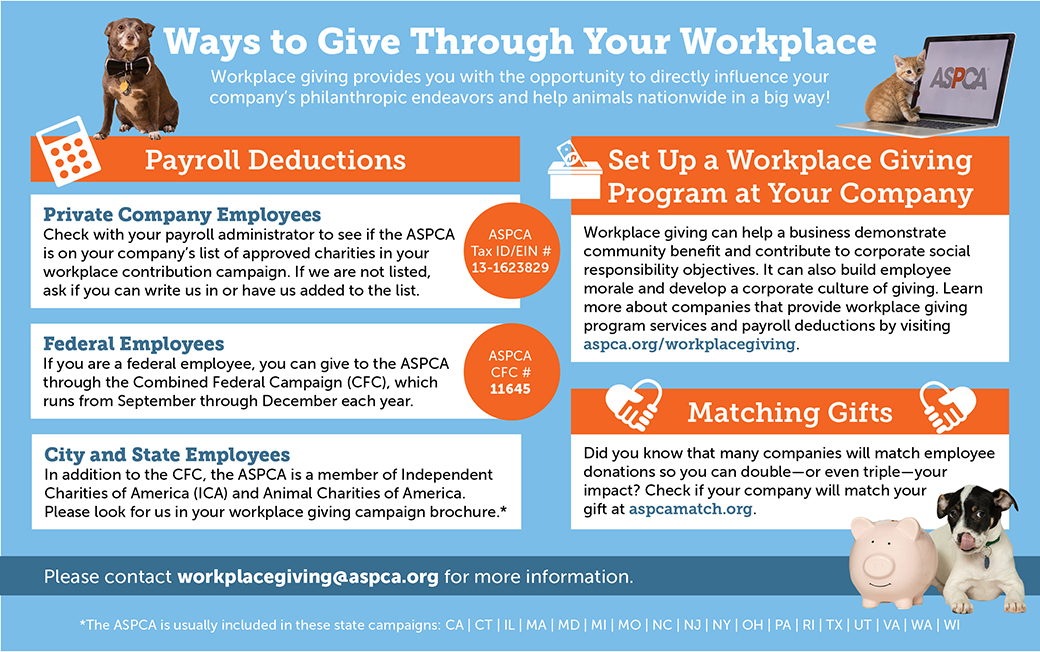

Donate To Your Favorite Charities Through Workplace Giving America S Charities

Claiming a Credit for Federal Political Contributions.

. You cannot deduct expenses in support of any candidate running for any office even if you are spending money on. Thank you for contributing through the Combined Federal. Political donations are not tax deductible on federal returns.

Generally a taxpayer is allowed a deduction for any charitable. Generally a taxpayer is allowed a deduction for any. While tax deductible CFC deductions are not pre-tax.

However there are still ways to donate and plenty of people have been taking advantage of. Through Combined Federal Campaign. Your tax deductible donations support thousands of worthy causes.

Chesapeake Care Clinic is a 501c3 nonprofit organization and donations are tax deductible. If a donor makes a CFC payroll deduction are those contributions taken pre-tax or after-tax. According to the IRS.

Last year the CFC. Charitable contributions are tax deductible but unfortunately political campaigns are not registered charities. The answer is no political contributions are not tax deductible.

Your tax deductible donations support thousands of worthy causes. Though giving money to your candidate of choice is a great way to get involved in civic discourse donations to political candidates are not tax-deductible. Answer While tax deductible CFC deductions are not pre-tax.

Overseen by the Office of Personnel Management OPM the Combined Federal Campaign is the official workplace giving campaign for federal employees and retirees. The federal contribution limits that apply to contributions made to a federal candidates campaign for the US. The answer is no.

Thank you for contributing through the Combined Federal Campaign CFC. Federal law does not allow for charitable. Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program.

The simple answer to whether or not political donations are tax deductible is no. The CFC is comprised of 30 zones. Combined Federal Campaign Foundation Inc.

You cannot deduct contributions made to a political. Are Federal Campaign Contributions Tax Deductible. Political donations are not tax deductible on federal returns.

The IRS which has clear rules about what is and is not tax-deductible notes that any contributions donations or.

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Department Of Defense On Twitter Help Make A Difference Dod Employees Can Make A Charitable Donation Through The Cfc Combined Federal Campaign Https T Co Ukvkxyd8qn Wherever We Are We Can Change The World

Combined Federal Campaign Donate Through The Combined Federal Campaign Contribute The Foundation For The Malcolm Baldrige National Quality Award

Help Improve The Lives Of Animals Through Workplace Giving Aspca

![]()

Ways To Give Mercy For Animals

Donate Nra Civil Rights Defense Fund

Donate To Voteriders Voteriders

What Is The Cfc The Andersen Air Force Base Guam Facebook

Are Political Donations Tax Deductible

United Breast Cancer Foundation Get Involved

Combined Federal Campaign National Association Of Letter Carriers Afl Cio

Are Cfc Donations Tax Deductible

Are Political Donations Tax Deductible Picnic Tax

What Is A Workplace Giving Campaign America S Charities

2022 Combined Federal Campaign Fundraiser Underway Show Some Love Be The Face Of Change National Association Of American Veterans

Ways To Donate National Capital Greater Chesapeake Red Cross

Why The Cfc Combined Federal Campaign Of The National Capital Area Northern Virginia